open end credit and closed end credit

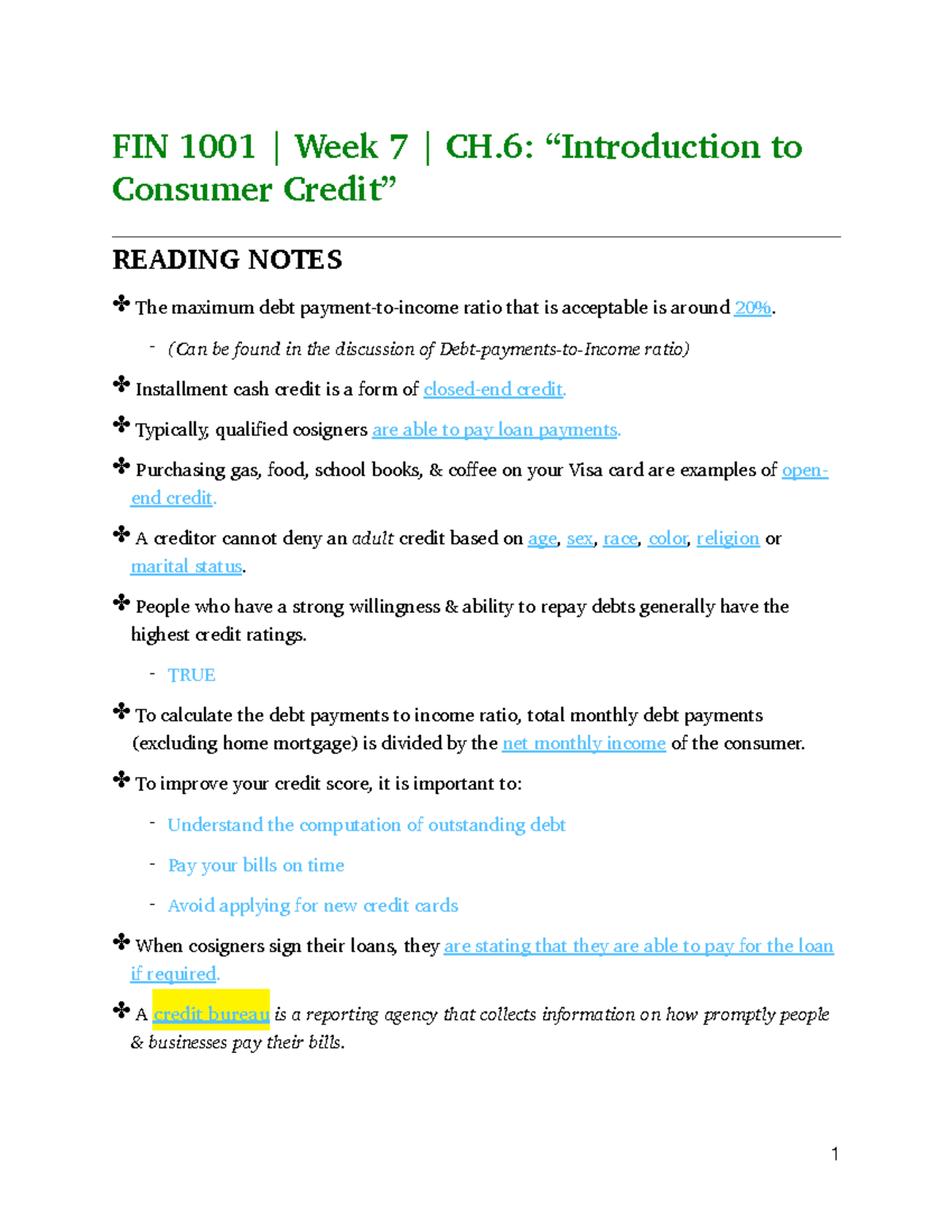

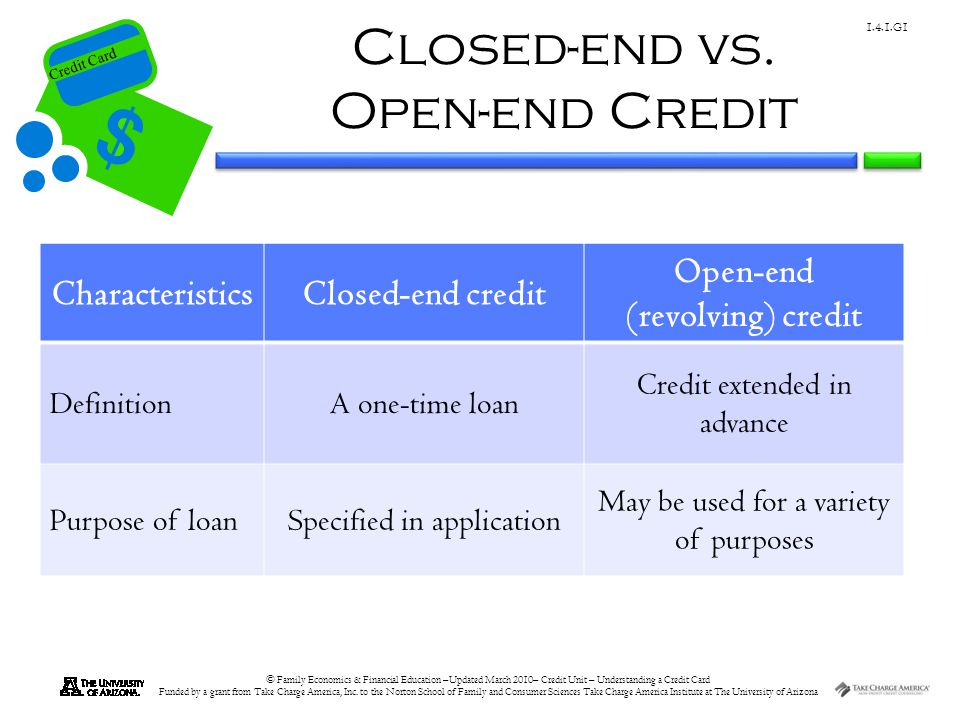

A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date. Open end loan can be borrowed multiple.

The 3 Main Types Of Credit Explained Self Credit Builder

What is the difference between closed end credit and open end credit.

. Consumer lending products aka consumer loans can be open-end credit or closed-end credit. Open End Credit vs. Open-end credit agreements are also sometimes referred to as revolving credit accounts.

With open-end credit you can. What are examples of open and closed ended. In a closed-end credit the amount borrowed is.

An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. Is a sort of credit that must be paid back in full by the end of the term on a specific day. A line of credit is a type of loan that borrowers can take money from over time rather than all at once.

Installment loans including a 144-month auto loan are examples of closed. With closed end credit you cannot add to what you have borrowed. In closed-end vehicles valuation is typically important for performance advertising and for reporting purposes enabling the investors to determine the Private credit.

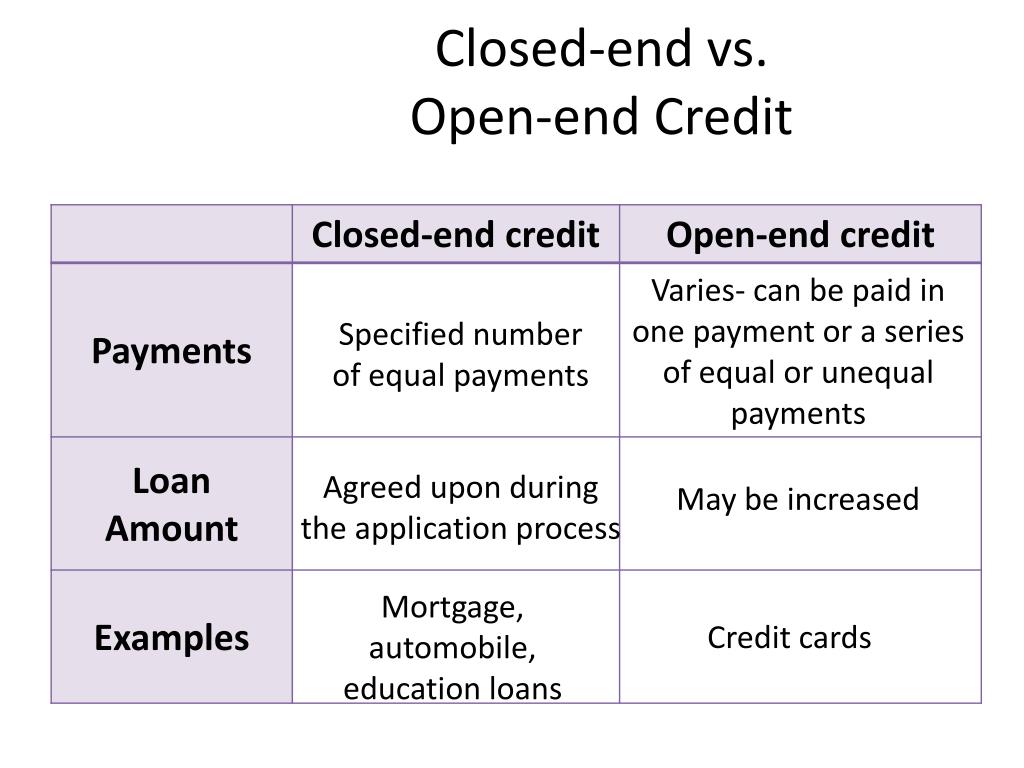

Lines of credit and closed-end loans differ primarily in. Closed-end and open-end credit differ depending on how funds are disbursed and how payments are made to the account. Lines of credit are different than closed-end loans as we explained previously.

Generally with closed-end credit the seller retains some form of control over the ownership title to the goods until all payments have been completed. If the terms of a credit card account under an open end consumer credit plan require the payment of any fees other than any late fee over-the-limit fee or fee for a payment. You must make payments on the loan until the interest and principal are paid off.

A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card. Examples of closed-end loans. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back.

When it comes to choosing between closed-end credit and open-end line of credit facilities there are a few factors that you will need to considerClose-end credits have. Open-end credit refers to any type of loan where you can make repeated withdrawals and repayments. Closed end credit must be paid off by a specific set dat.

Both may charge fees and an example. Open end credit can be borrowed repeatedly. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a.

The borrower can reuse. There are two basic kinds of lines of credit. Closed end credit is a loan for a stated amount that must be repaid in full by a certain date.

One example of open end credit is credit cards. Closed-end credit is a type of loan taken out in one lump sum and repaid in full by a specific date while open-end credit is much more flexible and reusable. Both of these credits charge interest.

5 Credit and Debt Management Types of Credit. Examples include credit cards home equity loans. All interest and financial charges agreed upon at the time of the.

Closed-end instalment credit and open-end credit Closed-end instalment credit- the repayment terms are well defined. For example a car company will have a.

Money Patrol Line Of Credit Facebook By Money Patrol What Is Line Of Credit People Who Don T Vote Have No Line Of Credit With People Who Are Elected

Consumer Credit Chapter 15 Section 1 Ppt Download

Ppt Warm Up April 15 Tax Day Powerpoint Presentation Free Download Id 1763748

The 3 Main Types Of Credit Explained Self Credit Builder

Solved 32 The Truth In Lending Act Includes O Closed End Chegg Com

Vplc Supports Legislation Regulating Line Of Credit And Open End Credit Lenders Virginia Poverty Law Center Virginia Poverty Law Center

Difference Between Open End Credit And Closed End Credit

:max_bytes(150000):strip_icc()/GettyImages-707452833-5ae73fce43a1030036ceb1d6.jpg)

How Closed End Credit Is Paid Off

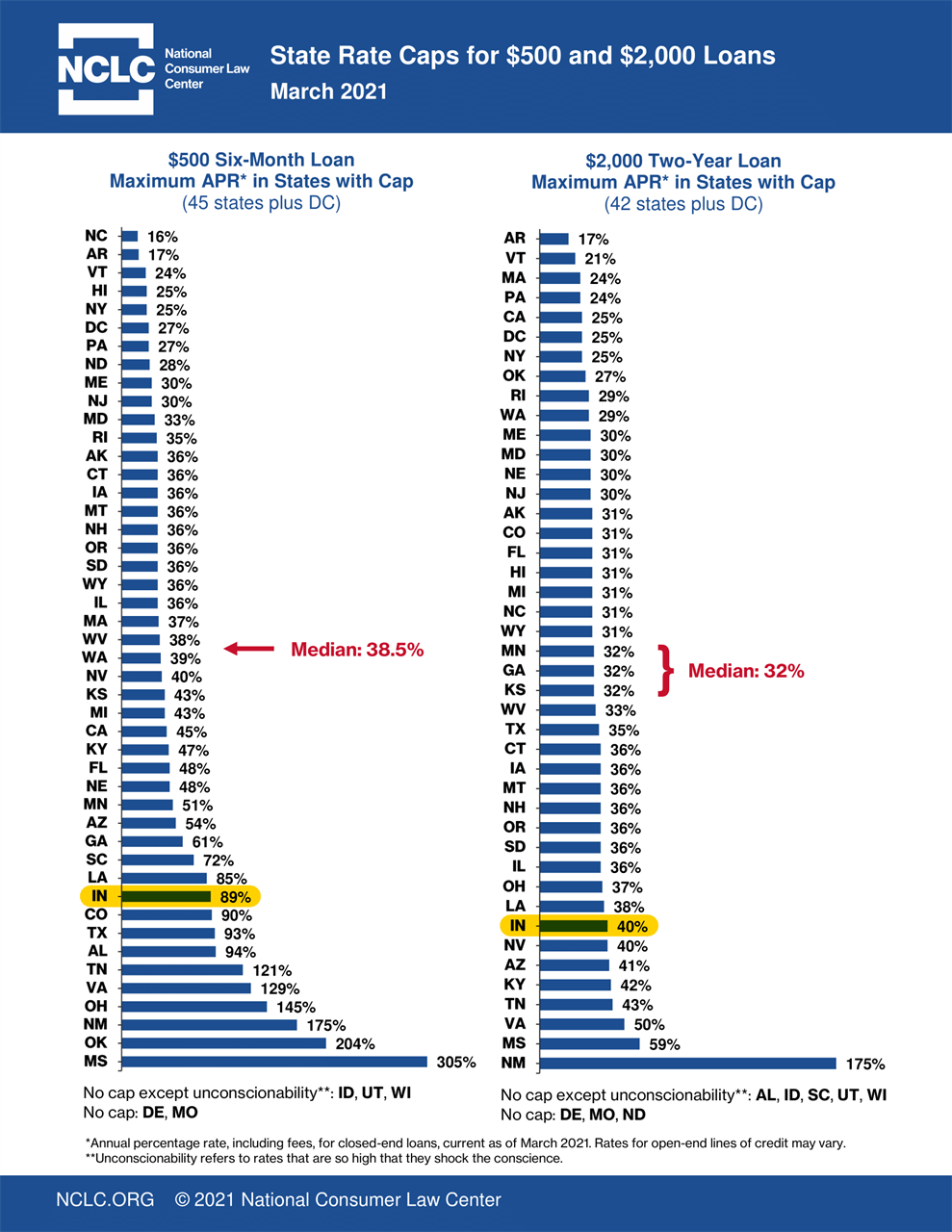

Prosperity Indiana New 50 State Survey Finds Losses For Indiana Consumers In Larger Longer High Cost Predatory Loans

Factors To Consider When Choosing Personal Line Of Credit Toyota Fcu

Solved Installment Noninstallment Credit This Type Of Chegg Com

Fin 1001 Week 7 Ch 6 Notes Fin 101 Csusb Studocu

Understanding Open End Credit Youtube

Credit Basics Vocabulary Words Flashcards Quizlet

Understanding Your Credit Card Ppt Download

Intro To Home Loan Closing Costs Mortgage Closing Costs Box Home Loans